I recently reviewed revenue data with several software clients, and the pattern was striking: SaaS companies transacting through AWS Marketplace were achieving 3x the total contract value compared to their direct sales channels. We’re talking about businesses generating millions in recurring revenue, and the marketplace was consistently their highest-performing channel.

This isn’t just about convenience. Something fundamental has shifted in how technical teams buy software.

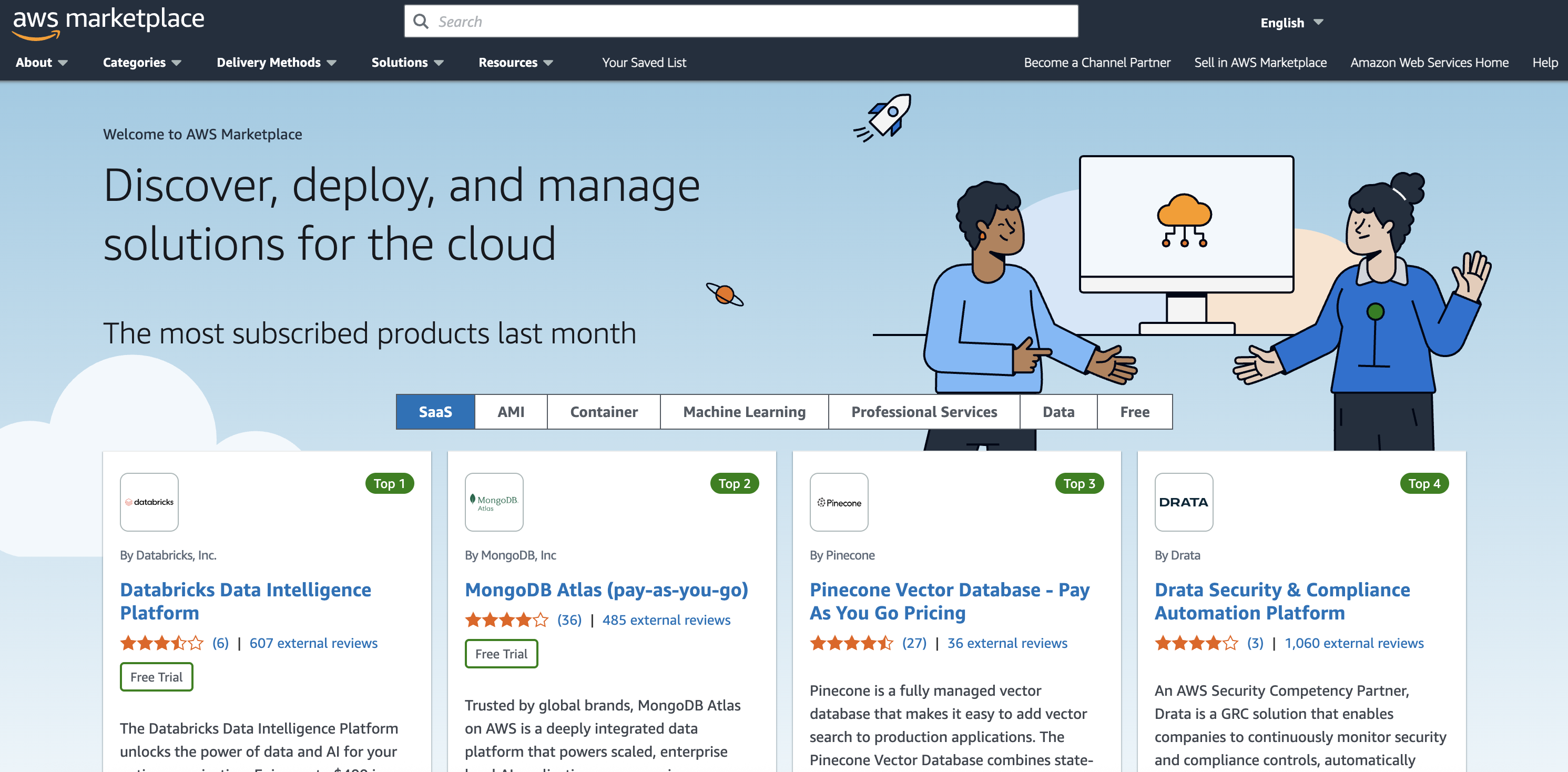

What Is AWS Marketplace?

Think of AWS Marketplace as Amazon.com for enterprise software and tech services. It’s where organisations discover, procure, and deploy software solutions directly through their AWS console. Listing there doesn’t guarantee success, but the right offering with the right positioning can become a revenue-generating machine.

The marketplace hosts everything from simple tools costing a few dollars monthly to enterprise platforms with million dollar price tags. What makes it powerful isn’t just the method of distribution; it’s how it fundamentally changes the buying process.

The Sweet Spot: Where Users Live in the Cloud

Not all software succeeds equally on AWS Marketplace. After analysing our clients’ performance data, clear patterns emerged. The categories that consistently achieve the most dramatic growth include:

- Developer and platform tooling

- Security and monitoring solutions

- Data analytics and ML tools

- Infrastructure management software

The common thread? These solutions serve users who already live in the cloud: software developers, platform teams, security professionals, etc. While software outside these categories can certainly succeed, this is where we’ve seen the biggest success stories.

The Surplus Budget Psychology

Here’s where it gets interesting. Our research revealed something unexpected about buyer behaviour: when software costs can be absorbed within existing cloud budgets, purchasing decisions change dramatically.

One client shared a perfect example. A customer facing a significant renewal couldn’t find budget allocation and was preparing to reduce their license count. The moment they discovered the software was available on AWS Marketplace, everything changed. They purchased a three-year deal worth more than triple their original renewal, with additional licenses. “It’s a common story”, the client noted.

Technical teams often have surplus cloud budget or budget flexibility that doesn’t exist in traditional IT procurement. Instead of fighting for approval on the cheapest option, they’re choosing premium offerings with more features. It’s procurement psychology in action: when the cost feels like part of your existing cloud spend rather than a separate line item, buyers become less price sensitive.

There’s another dynamic at play too. Many organisations have substantial AWS agreements that create spending thresholds they need to meet. When software purchases can offset against these cloud budgets, it helps them reach those thresholds while solving real business problems.

The simplified procurement process amplifies this effect. No separate vendor agreements. No complex approval workflows. Just click, deploy, and the cost appears on the cloud bill everyone’s already paying.

The Evolution of Shadow IT

This represents a fascinating evolution in enterprise software procurement. Traditional shadow IT meant teams using unapproved tools under the radar, hoping finance wouldn’t notice the expense reports. What’s happening with AWS Marketplace is different: it’s approved shadow IT.

Technical teams are now driving purchasing decisions through pre-approved cloud budgets, using platforms that have undergone AWS vetting processes. It maintains the speed and autonomy that made shadow IT appealing while operating within proper governance frameworks.

SRE teams are spinning up monitoring solutions. Developers are subscribing to productivity platforms. Security teams are deploying threat detection tools. All through the marketplace, all landing on the cloud bill, all happening without a single sales call.

Let’s be honest: most technical professionals would rather read documentation than sit through a sales demo. AWS Marketplace lets them skip the entire traditional sales process and get straight to what they actually want: trying the software.

What Makes Listings Work

Success on AWS Marketplace isn’t automatic. The listings that achieve 3x revenue growth share specific characteristics: they solve immediate technical problems, integrate seamlessly with existing services, and offer clear value propositions to technical users.

The pricing model also matters. Consumption based pricing aligns with cloud economics. Free trials remove friction. Enterprise-grade features such as SAML integration and audit logging justify premium positioning.

The Opportunity

For software companies serving technical audiences, AWS Marketplace represents more than just another sales channel. It’s a fundamental shift in how enterprise software gets discovered, evaluated, and purchased.

The question isn’t whether to consider marketplace strategy, it’s whether you can afford to ignore a channel that’s consistently delivering exceptional revenue growth for companies that get it right.

Ready to navigate your marketplace success? Watch our on-demand webinar with AWS where we map out the complete journey from listing to revenue growth, including the exact steps and insider tips that drive exceptional results.

This blog is written exclusively by The Scale Factory team. We do not accept external contributions.